Our Services Services for Skilled Workers

Immigration

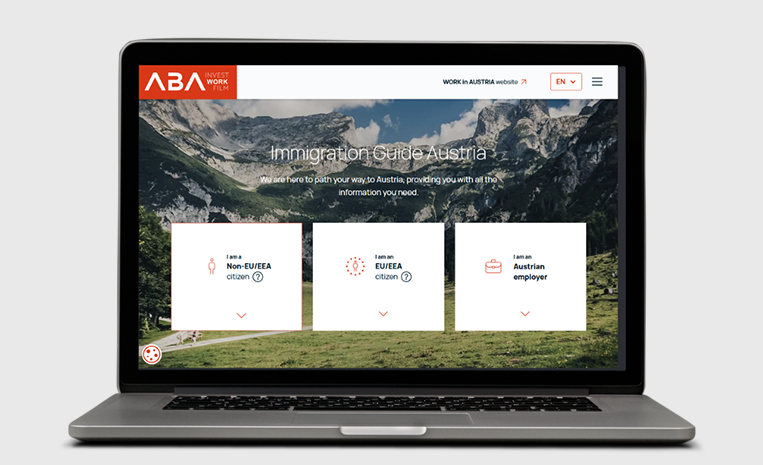

Guide Austria

The online platform Immigration Guide Austria provides answers to important questions about working in Austria, staying in Austria, living in Austria, family reunification, employment of foreigners and more.

Talenthub

Austria offers many opportunities on the job market. As an international talent, you can find attractive job offers, especially in the fields of ICT, metal technology, electrical engineering and life sciences. As an employer, you can advertise your vacancies in Austria free of charge and find potential applicants.

Living & Working

Online guide

Every beginning is difficult. But not when you get good advice. Use the Personal Guide of WORK in AUSTRIA and find valuable information about living, working, education, healthcare and culture in Austria.

We simply make it easy

WORK in AUSTRIA is the point of contact for specialists who would like to work in Austria as well as for companies looking for suitable specialists. We advise you free of charge.

Important Security Alert – Beware of Fraud Attempts

Currently, fraudulent emails and postal letters are circulating that falsely claim to be job offers from ABA – Austrian Business Agency or our WORK in AUSTRIA department. The goal of these scams is to obtain personal data and/or money.

Please note: WORK in AUSTRIA and ABA never send unsolicited job offers. If you receive a suspicious letter or email, do not respond, do not share any personal information, and do not make any payments.

Please contact your local authorities and report the incident to us. Your reports help us prevent spam and fraud attempts.